Senior U.S. and Chinese negotiators have agreed on a “framework” to move forward on trade talks after a series of disputes had threatened to derail them, representatives from both sides said.

The disputes — over visas, minerals and microchips — had shaken a fragile truce reached in Geneva last month to ease some of the massive tariffs that both countries had imposed on each other, leading to a phone call last week between President Trump and Chinese leader Xi Jinping to try to calm the waters. Tuesday night’s announcement of an apparent thaw in relations followed two days of talks in London.

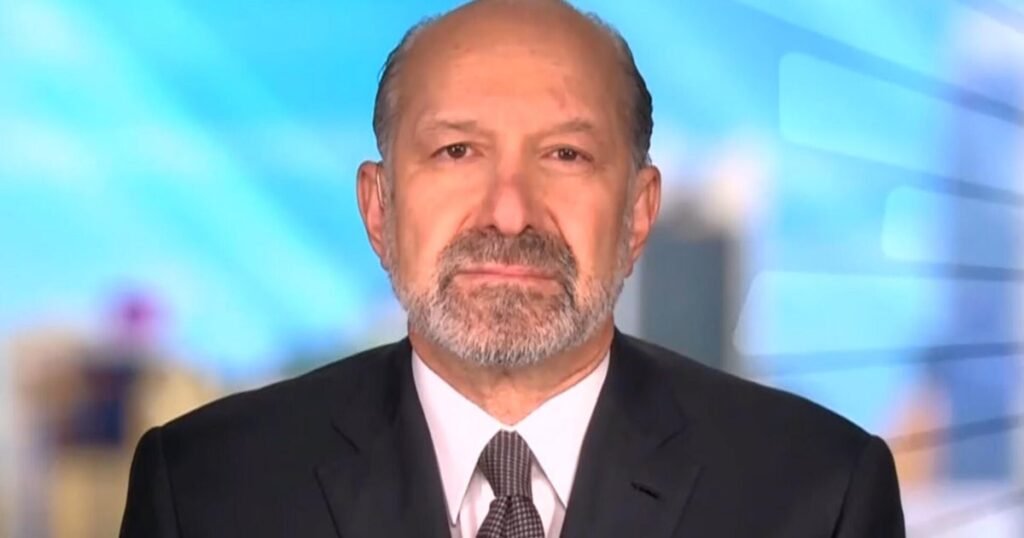

Commerce Secretary Howard Lutnick told reporters late Tuesday that negotiators have “reached a framework to implement the Geneva consensus.” He said the U.S. and Chinese sides will now go back to Mr. Trump and Xi, respectively, and they can start implementing their agreement if the two leaders approve.

Chinese negotiator Li Chenggang, a vice minister of commerce and China’s international trade representative, also said the two sides had agreed in principle on a framework, Chinese state media said.

Further details, including any plans for a potential next round of talks, were not immediately available.

The two sides had agreed in Geneva to a 90-day suspension of most of the 100%-plus tariffs they had imposed on each other in an escalating trade war that had sparked fears of a recession. Mr. Trump imposed large-scale tariffs on imports from China, leading to Chinese retaliatory tariffs on U.S. goods earlier this year.

But since the Geneva talks, the U.S. and China have exchanged angry words over advanced semiconductors that power artificial intelligence, visas for Chinese students at American universities and rare earth minerals that are vital to carmakers and other industries.

China, the world’s biggest producer of rare earths, has signaled it may ease export restrictions it placed on the elements in April. The restrictions alarmed automakers around the world who rely on them. Beijing, in turn, wants the U.S. to lift restrictions on Chinese access to the technology used to make advanced semiconductors.

Meanwhile, China has pushed back on the Trump administration’s vow to “aggressively revoke” the visas of some Chinese students who are studying at U.S. colleges, calling the move “politically motivated and discriminatory.”

Mr. Trump accused the Chinese side of violating the terms of the deal.

“So much for being Mr. NICE GUY,” the president wrote on Truth Social late last month.

Days later, China said the Trump administration had “unilaterally provoked new economic and trade frictions.”

Wendy Cutler, a former U.S. trade negotiator, said the disputes had frittered away 30 of the 90 days the two sides have to try to resolve their disputes, before massive tariffs go back into effect.

“The U.S. and China lost valuable time in restoring their Geneva agreements,” Cutler, now vice president at the Asia Society Policy Institute, told the Associated Press. “Now, only sixty days remain to address issues of concern, including unfair trade practices, excess capacity, transshipment and fentanyl.”

Cutler said it would be unprecedented for the U.S. to negotiate on its export controls, which she described as an irritant that China has been raising for nearly 20 years.

“By doing so, the U.S. has opened a door for China to insist on adding export controls to future negotiating agendas,” she said.

Mr. Trump said earlier that he wants to “open up China,” the world’s dominant manufacturer, to U.S. products.

“If we don’t open up China, maybe we won’t do anything,” he said at the White House. “But we want to open up China.”