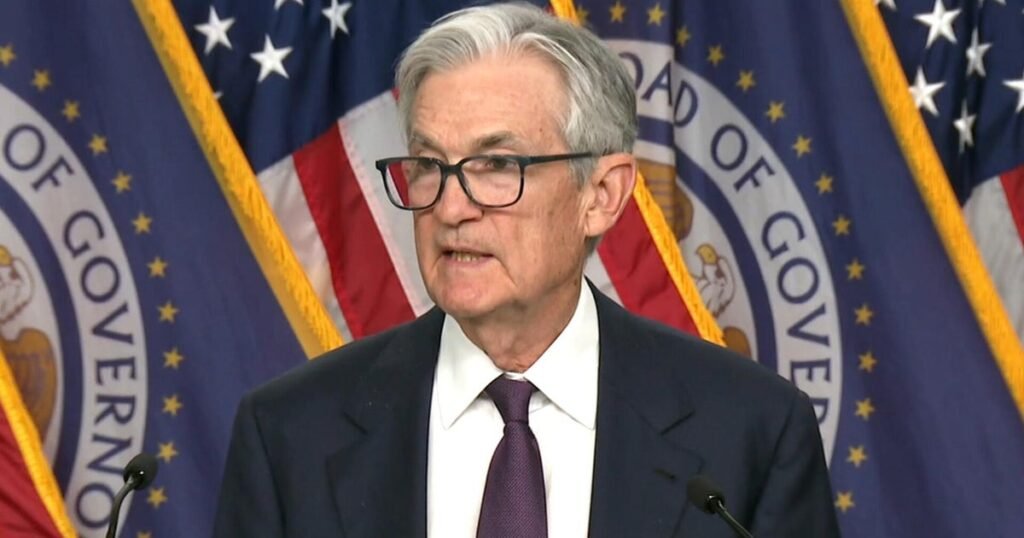

Federal Reserve Chair Jerome Powell is cautioning that the U.S. could face an increase in supply shocks. The comes a week after the central bank announced it would hold interest rates steady amid a period of economic uncertainty.

“We may be entering a period of more frequent, and potentially more persistent, supply shocks — a difficult challenge for the economy and for central banks,” Powell said Thursday at research conference in Washington, D.C., where U.S. bankers are meeting to discuss monetary policy.

Analysts have also warned that U.S. companies could face inventory shortfalls as a result of tariff-induced supply chain issues. Container bookings from China to the U.S. dropped as much as 60% following the pre-tariff spike in imports according to Flexport, a supply chain management company.

Powell acknowledged at the conference that the economic environment has changed since the Fed’s last strategy meeting in 2020, when interest rates were far lower than they are today.

“Longer-term interest rates are a good deal higher now, driven largely by real rates given the stability of longer-term inflation expectations,” Powell said on Thursday, referring to interest rates adjust for inflation.

The federal funds rate currently sits at 4.25% to 4.50%. The Fed last week decided to hold that rate steady — a sign it is still weighing the economic risks posed by the Trump administration’s tariffs. The central bank is scheduled to meet again in mid-June, where it’s expected to maintain its benchmark rate at its current range, according to predictions from CME FedWatch.

Inflation volatility

Powell also warned that higher real rates could unleash greater inflation volatility than what the U.S. experienced during the “inter-crisis period of the 2010s” — the timespan between the 2008 financial crisis and the 2020 COVID-19 pandemic when the economy was in recovery mode.

Inflation eased slightly last month but is still above the Fed’s 2% goal.

Powell’s comments come as the American consumers and businesses continue to grapple with economic uncertainty as a result of the Trump administration’s stop-and-go tariff policies. Mr. Trump and his team have been meeting with foreign leaders in recent weeks to negotiate deals before the 90-day pause on reciprocal tariffs lifts in July.

On Thursday, during an event with business leaders in Qatar, Mr. Trump said the Indian government has offered to eliminate tariffs on U.S. goods, reported Bloomberg.

Recent trade deal announcements with the U.K. and China have heartened the stock market which soared on Monday following the U.S. agreement with China. Still, Wall Street analysts and economists note that high tariffs aren’t going away anytime soon.

More from CBS News

contributed to this report.