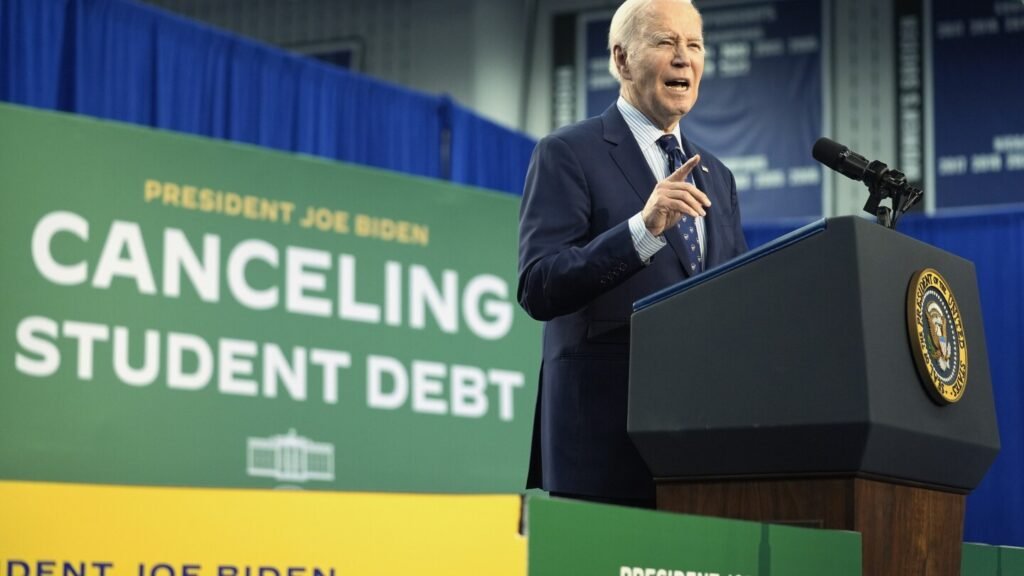

WASHINGTON (AP) — More than 260,000 former students of the now-defunct for-profit Ashford University are getting their student loans erased as the Biden administration presses ahead with debt forgiveness in its final days.

Ashford was once one of the nation’s largest for-profit college companies, with more than 100,000 students. It was owned by the company Zovio until the University of Arizona bought the online college in 2020.

The Education Department started forgiving loans for Ashford students after a California court found the college routinely misled prospective students about its accreditation, costs and the time it would take to graduate.

In 2023 the agency canceled loans for an initial 2,300 former Ashford students who applied for relief through the borrower defense program. The new action expands forgiveness to all former students who attended during the alleged misconduct, even if they didn’t apply for relief.

The administration’s new action will erase loan balances for borrowers who attended Ashford from March 2009 through April 2020.

In a rare move, the department also sought to forbid Zovio’s founder from acting as an executive for any institution that receives federal financial aid. A statement from the agency said it’s proposing to debar Andrew Clark for at least three years because he “not only supervised the unlawful conduct, he personally participated in it, driving some of the worst aspects of the boiler-room-style recruiting culture.”

The issue will be decided by the department’s Office of Hearings and Appeals. A message was left with an attorney who represented Clark when he was at Zovio.

The Biden administration previously said it would try to recoup money from the University of Arizona to offset the cancellation, saying the university inherited liability when it bought Ashford. That effort appears to have stalled, however, and it’s unlikely to be picked up by the Trump administration, which is expected to be far friendlier to the for-profit college industry.

Republicans in Congress have clashed with the Biden administration over student loan cancelation, saying it’s a presidential overstep that puts the burden on taxpayers who didn’t go to college. Rep. Virginia Foxx, R-N.C., issued a report this month saying Biden “tried to stretch every possible law” and abused the borrower defense program to cancel loans.

She took issue with the very practice used in the Ashford case — automatically canceling loans for big batches of borrowers even if they didn’t apply for relief. When Trump takes office, Foxx wrote, “the jig will finally be up.”

This month Biden separately announced a final round of forgiveness under the Public Service Loan Forgiveness Program. With that action, the administration had provided loan relief to more than 5 million borrowers through a variety of existing programs, more than any other president.

Still, Biden failed to deliver his promise for widespread student loan forgiveness. The Supreme Court blocked his plan to erase up to $20,000 for more than 40 million Americans, and a second attempt was tangled up in federal courts after several Republican states challenged it.

___

The Associated Press’ education coverage receives financial support from multiple private foundations. AP is solely responsible for all content. Find AP’s standards for working with philanthropies, a list of supporters and funded coverage areas at AP.org.